Minimum Salary, Maximum Assessment Base for Social Insurance

Effective from January 1, 2021, the minimum salary is increased from CZK 14,600 to CZK 15,200. The minimum hourly salary increase is from CZK 87.30 to CZK 90.50.

The maximum assessment base for the social insurance payments and, subsequently, the limit for a higher tax rate in 2021 is CZK 1,701,168. The monthly limit for a higher tax rate in 2021 is CZK 141,764.

Changes regarding Social Insurance

The amount of the monthly gross income when such income is processed as part of the health and social insurance system is increased from CZK 3,000 to CZK 3,500. Agreements of Work Performance up to the limit of CZK 3,499 per month will therefore not be subject to insurance payments.

Legislative Changes regarding Income Tax

An amendment to the Income Tax Act was published on December 31, 2020, so-called ‚tax package 2021‘. This amendment brings three main changes with respect to payroll processing.

Increase of Taxpayer Discount

As part of the tax package, an increase of taxpayer discount by CZK 3,000 was approved, the annual amount of taxpayer discount is now CZK 27,480. The monthly amount is CZK 2,320. There is approved another increase by CZK 3,000 for the year 2022, the annual amount of taxpayer discount will be CZK 30,840 in 2022.

Cancellation of Super-Gross Salary

Starting with 2021 employee income tax will no longer be calculated from so-called super-gross salary (gross income increased by social and health insurance payments of the employer), but from the gross income of the taxpayer. Simultaneously with this change, the solidarity tax is also abolished.

Progressive tax rates were put in place, replacing the original tax calculation. A tax rate of 15 percent will be used for income up to 48 times of average salary (CZK 1,701,168 in 2021, CZK 141,764 monthly). Amounts above this limit are subject to a tax rate of 23 percent.

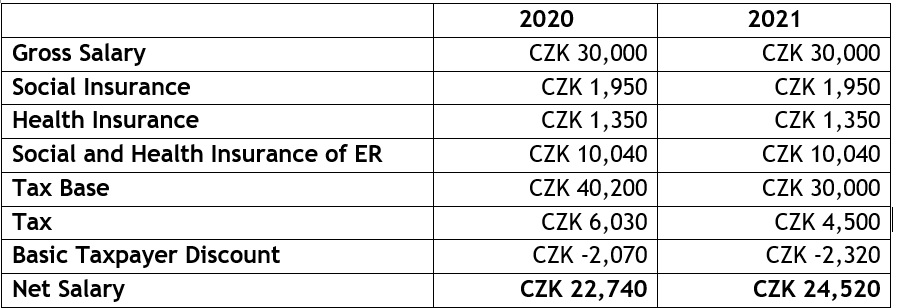

Legislative changes mentioned above shall bring higher net salary and are also a financial support in current financially demanding times. Below you can see examples of payroll calculation comparing the calculation method of the years 2020 and 2021.

Meal Contribution

The tax package also brings a new alternative on how to provide employees with a contribution for meals. This is a so-called meal contribution, a monetary contribution to employees for meals. The purpose of this change is less paperwork and lower incidental fees related to the use of meal vouchers. The monetary meal contributions are tax-exempt up to a limit of 70 percent of meal allowance for business trips lasting 5-12 hours specified for employees remunerated by wage (in the state sphere). This meal allowance for business trips is CZK 108 in 2021, 70 percent therefore results in a limit of CZK 75.60 per shift. However, the contribution can be provided only for shifts where the employee worked for at least 3 hours in the respective planned shift. It also cannot be provided for a shift where the employee is eligible for a meal allowance (for business trips).

Meal voucher contribution should always be provided beyond agreed work remuneration, as it is a non-claimable benefit for the employee.

Labour Act Amendment

Labour Act amendment took effect in summer 2020, bringing many legislative changes. Some of them became effective during last year, the changes below became effective only since 2021:

Vacation

Effective January 1, 2021, a legislative change that completely changes the previous conception of vacation came in place. Its main benefit is a more just calculation of vacation entitlement for part-time employees and for employees with irregular work shifts.

The main change is that vacation entitlement will now be in hours instead of days. Also, the number of hours worked (whether the full weekly shift plan has been worked) is now important for vacation entitlement, the calculation is not reflecting days anymore. The base vacation entitlement of four weeks remains unchanged. The law allows for three different methods of calculation, results of which may differ in some cases by 1 hour, due to rounding.

An employee who worked for the employer for 52 weeks in the respective calendar year is entitled to a whole annual vacation. If the employee did not work for the full 52 weeks, he or she is entitled to pro rata part, in the case he or she worked for at least 4 weeks in the respective calendar year. The pro rata part will be calculated as 1/52 of set work hours, multiplied by vacation entitlement per year.

Example of vacation calculation for an employee who did not work the whole calendar year

A full-time employee working 40 per week and entitlement of 5 weeks of vacation per year started his employment on September 1 and worked for 17 weeks and 3 days till the end of the year. Therefore, he is entitled to 17/52 of vacation per year. We do not take the 3 additional shifts into account.

To calculate the vacation entitlement, we first need to calculate the pro rata part of vacation per one week:

40 (weekly work hours) / 52 (weeks in a year) = 0,769

The vacation entitlement is, therefore:

17 (weeks worked) * 0,769 (proportionate part of vacation per week) * 5 (annual vacation entitlement in weeks) = 66 hours

Further, the conditions of shortening of vacation have been amended. Is it newly possible only in case of unexcused absence and only in the extent of the unexcused missed hours. Shortening of the vacation entitlement for long-time (excused) absence is not in place any more. However, some types of absences are newly considered as „worked“ hours for the purposes of the vacation entitlement only up to the limit of 20 weekly shifts under the condition that the employee has worked in the calendar year 12 weekly shifts as a minimum. This is applicable for absence due to illness, quarantine, parental leave or some personal obstacles. In case this absence in the calendar year is longer than this 20-week limit, there is no entitlement for vacation for these weeks above. As a final result, the vacation entitlement in case of long-term absences will remain very similar as based on the old rules. Only the method of calculation is different.

Example of vacation calculation in case of absences:

An employee has worked for first half of the year (26 weeks) the full weekly shifts and then was ill during the second half of the year (26 weeks). He works 40 hour per week and is entitled to 5 weeks of vacation per year.

For the first half of the year he is entitled for vacation for full 26 weeks. For the second half, he is entitled for vacation only for 20 weeks (illness is considered as worked up to 20 weeks per year only). Therefore, he is entitled to 46/52 of vacation per year.

To calculate the vacation entitlement, we first need to calculate the pro rata part of vacation per one week:

40 (weekly work hours) / 52 (weeks in a year) = 0,769

The vacation entitlement is, therefore:

46 (weeks worked) * 0,769 (proportionate part of vacation per week) * 5 (annual vacation entitlement in weeks) = 177 hours

Shared Job Position

The purpose of the shared job position is to create flexible conditions for those employees, who cannot manage the full-time. One job position shall be newly shared within two or more employees with shorter working hours but the same job description. These employees shall have the opportunity of setting their schedule and working hours according to their time options to fill average working hours per week within the four-week compensation period. The condition in order to implement this type of institute is an agreement between the employer and the individual employees. Such agreement can be a part of the employment contract. A shared job position can be terminated by written agreement or by the termination of the agreement without a reason with a 15-day termination period. This does not mean the termination of the employment contract. The employee is therefore further employed by the employer.

Recapitulation of Measures Related to COVID-19 with Impact on Payroll

The detailed legislative measures that aim to lower the impact on employers with respect COVID-19 pandemics has already been a subject of previous articles. Now, we would like to summarise the measures which stay in place and also add any possible changes.

„Antivirus“ Government Support Scheme

The „Antivirus“ government support scheme allowing the employers to claim the support for salary compensation is still in place. The compensation can be claimed in the following regimes:

Regime A:

– Quarantine for the first 14 days when the employer pays 60 percent of average reduced salary;

– Since October 1, 2020 regime Antivirus Plus is also in place, which, as part of regime A, supports those employers where the obstacle to work resulted from lockdown measures (restaurants, retail shops). In this case, the employers are compensated the full amount of salary compensations including social and health insurance payments, up to CZK 50,000 per employee per month.

Regime B:

– Obstacles to work on employer side due to ordered quarantine or child-care of a significant amount of employees (employee is paid full salary compensations derived from average salary)

– Obstacles to work on employer side due to limited sources necessary to business (employee is paid 80 percent of salary compensations derived from average salary)

– Obstacles to work on employer side due to limited demand for services, products, and other produce (employee is paid 60 percent of salary compensations derived from average salary)

The support for salary compensations is not applicable for employees in the termination period. To become entitled to this kind of support, the employer must follow the Labour Code and to have processed payment of salaries and statutory payments for the respective month. In order to request the support, the company needs to be registered in the government support scheme and the company has to be send a monthly report for the months in which the company wishes to request the support. Such report is made of declaration in PDF file and one XLSX file with employee data and figures of paid salaries, including employer health and social insurance payments. The report is to be sent electronically to the Labour Office by the end of the following month for which the support is requested.

Child Care Support

There still remains in effect so-called “crisis child are support” set after school closures in October 2020. Employees who take care of children younger than 10 years who visit a school that is closed due to COVID 19 government measures or who cannot take part in the classes due to quarantine in their family are entitled to this support. Child are support is also intended for caretakers of older children who are dependent on the care of other people or are using services of daily or weekly care centres. Employees who have Agreement on Work or Agreement Performance of a Work Assignment are also entitled to child care support in case their incomes are subject of social insurance.

Crisis child care support is provided in the amount of 70 percent of the daily assessment base, the minimum amount is CZK 400 per day.

Employees can request child care support by filling in a form available on the Czech Social Security Authority website (https://eportal.cssz.cz/web/portal/tiskopisy-zoppd-m), where the system generate Request identification number and under this number the application shall be further processed by the authority. The employee then prints and signs the form, gives the form to his or her employer who then sends the form to the Czech Social Security Authority. Confirmation of school closure is therefore no longer needed. The employee also states days he or she worked in the form. The support can be requested also for the weekends and national holidays but not for days of the school holiday. The form is to be filled separately for each month.

Ekonomika firmy na jednom místě a digitálně

Získejte více času na rozvoj svého podnikání a předběhněte konkurenci.

Účetnictví a reporting

Vyměňte šanony za propojený online účetní ekosystém včetně reportů na míru. Pomůžeme s implementací i vedením účetnictví, nebo doplníme vaši interní účtárnu.

Mzdy a personalistika

Digitalizujte mzdové účetnictví, docházky i tvorbu a podpisy pracovních smluv. Zpracování mezd pak nechte na nás – nebo budeme spolupracovat s vaším interním payroll týmem.

Poradenství a daně

Neztrácejte čas googlováním! Zeptejte se našich odborníků nejen na účetnictví a daně. Poradíme také, jak se zbavit papírování, zefektivnit procesy nebo vyměnit ERP. Jsme tu pro vás.

Rozhodněte se pro změnu. My najdeme řešení

Propojujeme externí a interní účetnictví

Zkombinujte výhody interní účtárny a outsourcingu. Získáte nonstop přehled a nižší náklady. Jak to funguje?

• Účetnictví: Sdílíte doklady online. Aplikace automaticky vytěží obsah a zaúčtuje je. Faktury schvalujete elektronicky včetně doplnění metadat (zakázky/střediska/činnosti).

• Mzdy a HR: Personální agendu od nástupů po docházky spravujete v online portálu. Informace automaticky putují do nástroje pro zpracování mezd.

My se postaráme o správnost účtování, reporting a spolehlivé fungování vašeho digitálního ekosystému.

Digitalizujeme korporáty i start-upy

Administrativa není jen nuda, ale taky černá díra na peníze. Své o tom ví velcí i malí. Díky digitalizaci a aplikacím v cloudu:

• významně snížíte náklady na zpracování mezd a účetnictví;

• zjednodušíte a vyjasníte interní procesy;

• máte více času na práci, která vás baví.

Technologie vás při růstu nenechají ve štychu – na dvojnásobný počet faktur nebo mezd nepotřebujete dvakrát tolik účetních.

Rozjedeme to rychleji, než byste čekali!

Digitalizace začíná výběrem a nastavením chytrých nástrojů, které vám ušetří čas i peníze.

1. Na úvodní schůzce probereme vše důležité.

2. Propojíte nás s kompetentní osobou z vaší firmy.

3. Implementace proběhne během 14 dnů až 1 měsíce.

Pokud stojí za to nejdřív upravit některé interní procesy, na rovinu vám to řekneme. Nenecháme vás vyhodit peníze oknem.