Labour Code Amendment

On June 10, 2020 the amendment of Labour Code was approved by the Czech Senate. The amendment is bringing many significant changes. Some of them will be valid from July 30, 2020. The main changes which are subject of this amendment are as follows:

Vacation

The most important change, which the amendment has brought, is valid from 2021. It is a completely new concept of calculation of the vacation entitlement and its drawing. The main goal is to achieve fair calculation for employees with part-time jobs or shift-workers. It should contain these main changes:

– Vacation entitlement shall be calculated by worked hours instead of worked days, as currently done;

– The employee who works for the employer for 52 weeks within one calendar year is entitled to the full year vacation entitlement. In the other case he/she is entitled to the pro-rata part under the condition of work for the employer for four weeks at least. The pro-rata part is being calculated as 1/52 of the agreed week working hours multiplied by the annual vacation entitlement;

– The basic annual vacation entitlement is four weeks;

– There is an adjustment of vacation shortening. The vacation shortening may be possible only in case of an unauthorised absences and only to the extent of the hours of unauthorised absences;

– There will be a possibility for the employees to ask for a transfer of the unused vacation days to the next year, only in case of taking at least 4 weeks of vacation in the current year.

Shared Job Position

The purpose of the shared job position is creating flexible conditions for the employees, who cannot manage the full-time. One job position shall be newly shared within two or more employees with shorter working hours but the same job description. These employees shall have the opportunity of setting their own schedule and working hours according their time options to fill average working hours per week within the four-week compensation period. The condition of implementation this type of institute is to conclude an agreement between the employer and the individual employees. This agreement can be a part of the employment contract. Also, the provisions related to the shared job position will become effective in 2021.

Documents Delivery

The amendment of the Labour Code shall further bring to the employer and the employee a simplification of the process of the document delivery.

The employer is generally obliged to deliver the documents to the employees primarily personally in a workplace. In case, this way of delivery is not possible, the employer can newly select any of the alternative options given by law. The following options are possible:

– Delivery to the data-box of the employee (this delivery method requires an approval of the employee). The delivery fiction applies in case the employee does not log in the data-box within 10 days from the delivery of the document to the data-box.

– Delivery through the postal service provider – the delivery can be newly sent to the address notified by the employee as a correspondence address. The employee therefore partially bears a responsibility for delivery of the documents to the correct and up-to-date address. Further, the deadlines given by the Labour Code and the postal mail provider deadlines have been synchronised so that the delivery period is newly 15 calendar days.

The delivery fiction is further applicable in case the employer refuses to take-over the document, does not provide an adequate support or disables the document delivery in any other way. In such a case the document is considered as delivered on the day when such a situation occurred. Also, the employee has a possibility to deliver the documents to the employer through the data-box. The document is considered as delivered on the day of delivery to the data box of the employer, notwithstanding the fact it is opened or not. A consent of the employer is not required in this case.

Issuing Confirmations on Employment

The employers will not be newly obliged to issue the Confirmations on Employment to those employees who have worked for the employer based on the agreement on performance of a work assignment and their income was not subject of the sickness insurance.

Compensation for Health Damage

The amendment regulates the amount of compensation for dependants of the employees who died as a result of work injury or work disease. The amount of these compensations will be derived from the average salary, which shall ensure its development through the time.

Others

The amendment further regulates the conditions of the transfer of employment rights and obligations, conditions of delegation of employees within the EU (newly the conditions shall vary depending on the period of delegation) and their remuneration or specifies the conditions for recall of manager.

Social Security Legislation Changes

Effective July 1, 2020, several social security legislative changes came into effect. Their goal is to make the process of documents delivery more automatic and further the support of the employers with respect to the negative impact arisen from the COVID-19 restrictions.

With respect to documents submission, the following changes are in place:

– From July 1, 2020, it is possible to submit the monthly report of paid insurance in the electronic format only, i.e. sending to the electronic address or through the company data-box in the stated structure in XML format. If the report is submitted in any other way, it will not be taken into consideration. This change applies for the June reports submitted in July already;

– Effective June 1, 2020 it is possible to pay the insurance, penalties, insurance surcharges or fines of the illness insurance in a cash-less way only;

– Effective September 1, 2020, there will be possible to submit the pension sheets, employee registrations and de-registrations and any documents related to illness payments in the electronic way and format and structure given by the Social Security Authority only;

– In case the employer is not able to submit the documents electronically and can prove the reason, the paper format including the explanation for this method of submission will be accepted;

– The original intention to shorten the period for registration of employees from original 8 to 2 calendar days has not been approved and the deadlines remain unchanged even after September 1, 2020.

Postponing of Employer’s Social Insurance Payments

For the months May, June and July 2020, the employers have a possibility to postpone that part of the social insurance payments they are obliged to pay from the employees’ salaries (24.8 %). This amount can be paid additionally until October 20, 2020. In case this deadline is met the late payment penalty will be reduced by 80 % and in case the penalty amount will be lower than CZK 1,000 it will not be charged at all. The employer who decides to postpone his payments does not have to inform the Social Security Authority in any way. The only obligation is to pay the part of insurance paid by employees (6.5 %) within statutory deadlines. The amount

on the monthly reports of the social insurance must be reported full, i.e. the part paid by the employer (which is subject of the postponing) as well as the part deducted from employee’s salary.

Insurance Remission

The purpose of this legislative change (Antivirus C) is to keep the employment and global support of the small companies which, notwithstanding the COVID-19 restrictions managed to keep their employees. Therefore, the employers gain the possibility to reduce the bases of the social insurance paid by the employer and not include the salaries of those employees whose employment is valid at the end of the respective month. This is applicable for the months June, July and August 2020. The maximum claimable amount per each employee is CZK 52,253. The deduction is not applicable for those employees who are in termination period and their employment was terminated for redundancy reasons.

The remission of the insurance is possible in case the following conditions are fulfilled:

– The number of employees (who are participants of the illness insurance), including the employees on maternity or parental leave does not on the last day of the calendar month exceed number 50;

– The number of employees on the last day of the reported month reaches at least 90 % of the employees the company had on March 31, 2020;

– The total social insurance bases of the employees in the reported month reaches at least 90 % of the total bases for March 2020. This amount may be affected e.g. by bigger number of employees taking care of their children due to school closing or on sick leaves;

– The remaining part of the insurance is paid within statutory deadlines;

– The employer does not claim any financial support within the programs Antivirus A or B within the reported month.

For the purpose of reduction of social insurance base, the form for monthly reports of the social insurance has been adjusted, so that the employer can report the claimed amount of reduction.

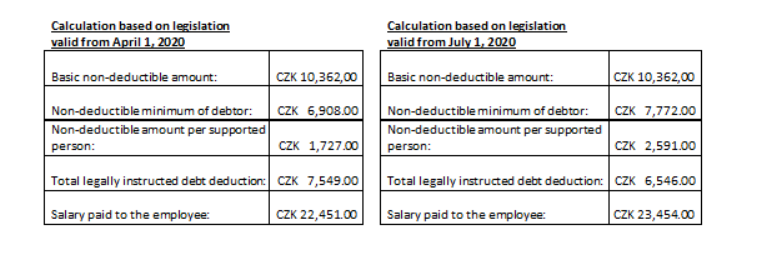

Changes in Legally Instructed Debts Calculation

During the year 2020, there have been several legislative changes which have impact on calculation of the legally instructed debts deduction. We have prepared for you the brief basic recapitulation of them:

January 2020 – normative costs

Effective January 1, 2020, the non-deductible amount has been increased from CZK 6,429 to CZK 6,502 due to the change of the normative costs for living.

April 2020 – life minimum

Effective April 1, 2020, the existence minimum has been increased from CZK 2,200 to CZK 2,490 and the life minimum from CZK 3,410 to CZK 3,860.

July – ratio of the non-deductible minimum

This adjustment changes the way of calculation of the non-deductible minimum of the debtor as follows:

– The non-deductible minimum for the debtor shall be newly calculated as ¾ from the sum of the life minimum and normative costs for living instead of original 2/3;

– The non-deductible amount per supported person shall be newly calculated as 1/3 of the basic non-deductible amount instead of original ¼.

For better understanding of the impact of this legislative change, we have made an example of the basic debt of the single employee with one child having a monthly net salary of CZK 30,000:

Recapitulation of Measures Related to COVID-19 with Payroll Impact

The legislative measures aiming to minimalize the impacts of COVID-19 restrictions have been described in more detail in previous articles. Herewith, we would like to summarize approved changes and the measures which are still in effect.

Antivirus Programs

The Antivirus program compensating the expenses of the employers who were obliged either to announce the quarantine or to reduce their operation in any way, has been extended until the end of August 2020. The reason for that were the pertaining impacts for some employers. Both regimes of the program, i.e. A (compensation for salaries within quarantines or in case the company is closed due to the government decision) and B (other obstacles connected with governmental

decisions, i.e. partial unemployment, reduction of inputs access etc.) have been extended.

The new regime, Antivirus C, supporting the small companies by social insurance remission is described in the text above in more detail.

Family Member Care Allowances

Effective July 1, 2020, the conditions for allowances for family member care return to the original arrangements as was applicable before the governmental decision related to COVID-19. The allowances will be paid for the period of 9 calendar days or 16 calendar days in case of single parents. The amount is again 60 % of the daily base and the age limit of children the employee takes care about is again reduced to 10 years.

Deadline for Tax Return Filing

The deadline for income tax return has been re-extended until August 18, 2020. There is no duty to prove the connection with coronavirus as a reason for late filing.

Other Legislative Changes, which Shall Come into Effect

From 2021

Meal Contribution

On June 22, 2020 the government approved a complex of tax changes for the year 2021. With respect to the payroll, it can bring rather interesting change in the form of the meal contribution which shall become an alternative option to the company canteens or meal vouchers. The employers could pay to their employees a financial amount for the purposes of meal instead of the meal vouchers. The benefits would remain the same as actually valid for the meal vouchers. The main goal of the measure is to simplify the administrative and reduce the extra costs connected with meal vouchers use.

Cancellation of the Super-gross Salary

The newly announced goal of the government is to discuss the possibility of cancellation of the super-gross salary from 2021, within this summer. As a part of the negotiations the possibility of cancellation or reduction of the social security payments shall be considered.

Ekonomika firmy na jednom místě a digitálně

Získejte více času na rozvoj svého podnikání a předběhněte konkurenci.

Účetnictví a reporting

Vyměňte šanony za propojený online účetní ekosystém včetně reportů na míru. Pomůžeme s implementací i vedením účetnictví, nebo doplníme vaši interní účtárnu.

Mzdy a personalistika

Digitalizujte mzdové účetnictví, docházky i tvorbu a podpisy pracovních smluv. Zpracování mezd pak nechte na nás – nebo budeme spolupracovat s vaším interním payroll týmem.

Poradenství a daně

Neztrácejte čas googlováním! Zeptejte se našich odborníků nejen na účetnictví a daně. Poradíme také, jak se zbavit papírování, zefektivnit procesy nebo vyměnit ERP. Jsme tu pro vás.

Rozhodněte se pro změnu. My najdeme řešení

Propojujeme externí a interní účetnictví

Zkombinujte výhody interní účtárny a outsourcingu. Získáte nonstop přehled a nižší náklady. Jak to funguje?

• Účetnictví: Sdílíte doklady online. Aplikace automaticky vytěží obsah a zaúčtuje je. Faktury schvalujete elektronicky včetně doplnění metadat (zakázky/střediska/činnosti).

• Mzdy a HR: Personální agendu od nástupů po docházky spravujete v online portálu. Informace automaticky putují do nástroje pro zpracování mezd.

My se postaráme o správnost účtování, reporting a spolehlivé fungování vašeho digitálního ekosystému.

Digitalizujeme korporáty i start-upy

Administrativa není jen nuda, ale taky černá díra na peníze. Své o tom ví velcí i malí. Díky digitalizaci a aplikacím v cloudu:

• významně snížíte náklady na zpracování mezd a účetnictví;

• zjednodušíte a vyjasníte interní procesy;

• máte více času na práci, která vás baví.

Technologie vás při růstu nenechají ve štychu – na dvojnásobný počet faktur nebo mezd nepotřebujete dvakrát tolik účetních.

Rozjedeme to rychleji, než byste čekali!

Digitalizace začíná výběrem a nastavením chytrých nástrojů, které vám ušetří čas i peníze.

1. Na úvodní schůzce probereme vše důležité.

2. Propojíte nás s kompetentní osobou z vaší firmy.

3. Implementace proběhne během 14 dnů až 1 měsíce.

Pokud stojí za to nejdřív upravit některé interní procesy, na rovinu vám to řekneme. Nenecháme vás vyhodit peníze oknem.