Actual Legislative Changes

Having Impact on Payroll Process in 2019

Tax Legislation Changes

From May 1, 2019, the monthly withholding tax payment for the employees who have not signed the tax declaration shall be increased to CZK 3,000. This is a result of unification with the limit of employee income setting up the participation in the illness insurance system which has been increased already from January 1, 2019. This change does not have any effect on the withholding tax in case of employees working based on the Agreement on Performance of a Work Assignment who have not signed the tax declaration. In this case the limit of CZK 10,000 remains unchanged.

Social Security Legislation Changes

From July 1, 2019, there comes into effect a significant change in payment of salary compensation during the illness of the employee. It covers mainly cancellation of the waiting period, i.e. the salary compensation shall be paid from the first day of illness already. In order to be entitled to salary compensation from the first day of illness, the illness must start after the effective date of this legislative change. Therefore, the first three days of the illness, which starts on June 30, are not subject of the salary compensation.

As a compensation for the employer, the rate of the social insurance paid by the employer shall be reduced from current 25 % to 24.8 %.

Changes in Legally Instructed Debts Calculation

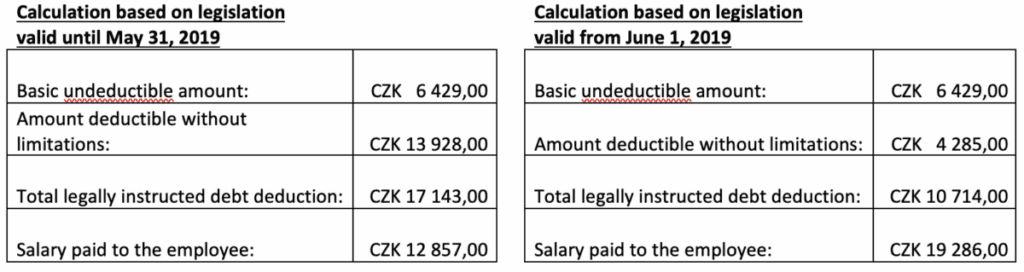

In order to improve the position of the debtors in the legally instructed debt proceedings, there have been approved a change in calculation of the legally instructed deductions from June 1, 2019. This change mainly increases the limit above which the remaining net salary amount calculated based on the Section 279 of the Code of Civil Procedure can be deducted without any limitations. From June 1, 2019 this amount represents the double amount of the life minimum of the individual and normative cost of living per person.

That means that for deductions made in the period up to May 31, 2019 the amount above which the net salary was deductible without limitations, was CZK 9,643, however, from June 1, 2019 it is already double, i.e. CZK 19,286.

This change will have impact on the 2019 June salary for the first time. For better understanding of this legislative change, we have made an example of the basic debt of the single employee without children having a monthly net salary of CZK 30,000:

Other Legislative Changes, which Shall Come into Effect from 2020

From 2020 there shall be an increase of the parental contribution, which the families can claim until their child reaches the age of 4 years, from CZK 220,000 to CZK 300,000, respectively from CZK 330,000 to CZK 450,000 (in case more children are born).

The new contribution amount is applicable for all whose child is born in 2020 and also for those who have been already withdrawing the parental contribution in previous years, however continue at the beginning of 2020. On the other side, the families who have a child under the age of four, however fully withdrawn the parental contributions before the year 2020, are not entitled to the increased amount.

The proposal of the Ministry of Labour and Social Affairs has been approved by the government and shall be now submitted to the parliament. Its approval is very probable.

Anna Vraná Rubínová

Payroll Consultant Senior

Ekonomika firmy na jednom místě a digitálně

Získejte více času na rozvoj svého podnikání a předběhněte konkurenci.

Účetnictví a reporting

Vyměňte šanony za propojený online účetní ekosystém včetně reportů na míru. Pomůžeme s implementací i vedením účetnictví, nebo doplníme vaši interní účtárnu.

Mzdy a personalistika

Digitalizujte mzdové účetnictví, docházky i tvorbu a podpisy pracovních smluv. Zpracování mezd pak nechte na nás – nebo budeme spolupracovat s vaším interním payroll týmem.

Poradenství a daně

Neztrácejte čas googlováním! Zeptejte se našich odborníků nejen na účetnictví a daně. Poradíme také, jak se zbavit papírování, zefektivnit procesy nebo vyměnit ERP. Jsme tu pro vás.

Rozhodněte se pro změnu. My najdeme řešení

Propojujeme externí a interní účetnictví

Zkombinujte výhody interní účtárny a outsourcingu. Získáte nonstop přehled a nižší náklady. Jak to funguje?

• Účetnictví: Sdílíte doklady online. Aplikace automaticky vytěží obsah a zaúčtuje je. Faktury schvalujete elektronicky včetně doplnění metadat (zakázky/střediska/činnosti).

• Mzdy a HR: Personální agendu od nástupů po docházky spravujete v online portálu. Informace automaticky putují do nástroje pro zpracování mezd.

My se postaráme o správnost účtování, reporting a spolehlivé fungování vašeho digitálního ekosystému.

Digitalizujeme korporáty i start-upy

Administrativa není jen nuda, ale taky černá díra na peníze. Své o tom ví velcí i malí. Díky digitalizaci a aplikacím v cloudu:

• významně snížíte náklady na zpracování mezd a účetnictví;

• zjednodušíte a vyjasníte interní procesy;

• máte více času na práci, která vás baví.

Technologie vás při růstu nenechají ve štychu – na dvojnásobný počet faktur nebo mezd nepotřebujete dvakrát tolik účetních.

Rozjedeme to rychleji, než byste čekali!

Digitalizace začíná výběrem a nastavením chytrých nástrojů, které vám ušetří čas i peníze.

1. Na úvodní schůzce probereme vše důležité.

2. Propojíte nás s kompetentní osobou z vaší firmy.

3. Implementace proběhne během 14 dnů až 1 měsíce.

Pokud stojí za to nejdřív upravit některé interní procesy, na rovinu vám to řekneme. Nenecháme vás vyhodit peníze oknem.